🏦 Banks Tiptoe Back Into CRE Lending — But Old Loan Troubles Still Haunt the Market ⚠️

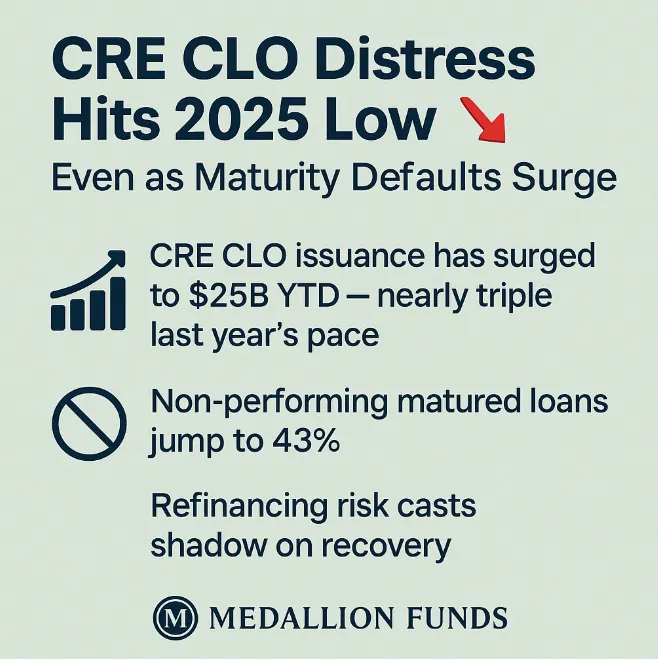

🏦 Banks Tiptoe Back Into CRE Lending — Even As Old Troubles Stick Around After two years of tightening credit, frozen loan committees, and conservative underwriting, banks are finally stepping back into the commercial real estate (CRE) arena